1 (800) 734 - 9900

Toll FREE Unlimited Access For Club Members

Spiegel & Utrera, P.A. General Counsel Club Benefits:

- General Counsel for your business - Let Spiegel & Utrera, P.A. help you grow your business.

- Unlimited strategic business advice

- Unlimited legal advice - both business and personal.

- Toll FREE access

- Entrepreneur's Alert® Newsletter (six issues published annually)

- Advertise for 1 year on the Client Bulletin Board on our website.

(Change your ad monthly)

One Payment of $139.95 - (1 year membership)

Select this valuable service at the time of ordering your corporation or LLC and receive an additional one month Bonus – so that your first year of service will cover 13 months. PLUS take a $50 discount, so you PAY ONLY $89.95 for the first 13 months of service.

NON-General Counsel Club members can still receive legal and strategic business advice at an affordable rate of $50 for each 15 minutes or fraction thereof with a 15 minute minimum.

Simply call 1 (800) 734 - 9900.

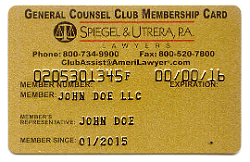

GENERAL COUNSEL CLUB

As a business person, you know how important it is to get the right information before making any major decisions. Unfortunately, consulting with lawyers is usually very expensive, leaving you relying on unqualified opinions or going at it alone. For less than 40¢ per day you can obtain unlimited assistance over the phone for all matters relating to legal and strategic business advice. As a member of the Spiegel & Utrera's General Counsel Club, Spiegel & Utrera, P.A. attorney's are standing by to assist you with your legal matters. As a member of the Spiegel & Utrera's General Counsel Club, you enjoy the following benefits:

- Spiegel & Utrera, P.A. will act as your corporation's General Counsel.

- You will have unlimited access to free telephone support relating to any strategic business advice or legal problem you wish to discuss such as:

|

|

- You will receive the Spiegel & Utrera, P.A. newsletter, "Entrepreneur's Alert®", which is published six times per year by Spiegel & Utrera, P.A.

- You are entitled to place an advertisement for up to one year on the Client Bulletin Board on Spiegel & Utrera, P.A.'s website. You may change your ad monthly. The ad classifications are Business Opportunities, Franchises, Capital to Invest, Capital to Lend, Capital Wanted and Miscellaneous. Please go to www.amerilawyer.com/clientbulletinboard/ to enter your advertisement.